property tax in france 2019

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. To find out more please refer to the International section of the website concerning nonresident individuals.

Pin On Frugalfrance Com Best Of The Blog

Income Tax Rates and Thresholds Annual Tax Rate.

. 38 rows Todays map shows how European OECD countries rank on property taxes continuing our series on the component rankings of the 2019 International Tax Competitiveness Index Although an important element when measuring the neutrality and competitiveness of a countrys tax code property taxes account on average for less than 5. The sum payable will be as advised on your income tax notice for 2018 on 2017 income. Over the same period the.

These costs which are mainly for the public treasury are calculated according to the type of property its location and characteristics and your method of financing. To be eligible your income must not exceed a certain threshold then you will benefit from a reduction of 30 in 2018 65 in 2019 and complete abolition by 2020. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise.

Together these taxes are the equivalent to UK Council Tax. The main developments this year concerning the fast disappearing local residence tax in France the taxe dhabitation. The planned measures will see an initial 30 reduction in your residential tax bill from November 2018.

The property tax on built lands taxe foncière is applied to properties built in. Its important to keep in mind that this tax calculator is meant to be an estimation of your tax burdern and not a precise number. DINR PART - March 10 2021.

Reductions in the corporate tax rate and the tax burden placed on. Over this period revenue from taxes increased steadily reaching almost 88 billion. The tax-to-GDP ratio in France has increased from 434 in 2000 to 454 in 2020.

On average for the purchase of an older property the transfer costs amount to 75 of the sale price whereas for a new property the transfer costs are 3. France Non-Residents Income Tax Tables in 2019. As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2019 is 49 45 4.

There may be a slight differences. In France taxes are levied by the government and collected by the public administrations. The main two taxes in France for property are the t axe foncière and the taxe dhabitation.

If youre selling land or property or have assets of more than 13 million there may be capital gains tax to consider too. Pay-as-you-earn tax in 2019. France 2019 Income Tax Calculator.

You also have to pay occupiers tax taxe dhabitation or French property tax taxe foncière. Friday 08 November 2019. The former is paid by the landlord and the latter by the occupier whether thats a landlord or a tenant.

The 2019 budget includes tax simplification efforts to eliminate about 20 small taxes and recently President Macron has proposed to reform the so-called exit tax. This graph presents the total revenue generated by income taxes in France from 2006 to 2019 in million euros. The OECDsannual Revenue Statistics report found that the tax-to-GDP ratio in France increased by 05 percentage points from 449 in 2019 to 454 in 2020.

Between 2019 and 2020 the OECD average slightly increased from 334 to 335. Note that the proposed measures dont apply to second home owners in France. The government is in the process of lowering the French corporate tax rate from 333 to 25 percent by 2022.

Wealth tax IFI Even if you are no longer a resident of France for tax purposes you are still liable for weath tax impôt sur la fortune immobilière on your assets located in France. Abolition of the Taxe dHabitation. Largely speaking these taxes cover local services such as street cleaning waste.

Real property tax - Rental income for residential apartments are taxed at the normal PIT rates after the deduction of all the expenses borne by the landlords. Since 2019 a Pay-As-You-Earn PAYE system has been used universally throughout France. Initially set to start in 2018 France will introduce a pay-as-you-earn scheme for the collection of the income tax in January 2019.

In May 2019 everyone will be obliged make a tax return on their 2018 income and although a full tax assessment will be carried out no tax will be. France 2020 Income Tax Calculator. As we have previously reported in the Newsletter one of the two local property rates the taxe dhabitation is being abolished on the principal residence.

From January 2019 the tax office will deduct a sum each month 15th day as a withholding tax on 2019 income. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. Owners are liable for a tax based on the rental value of the property assessed by the tax authorities.

In Depth Guide To French Property Taxes For Non Residents Expats

French Property Prices Analysis Of The Market Notaries Of France

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

Property Tax Cap Favours Nova Scotia S Wealthy Saltwire Property Tax Nova Scotia Property

French Taxes I Buy A Property In France What Taxes Should I Pay

Unsecured Property Tax Los Angeles County Property Tax Portal

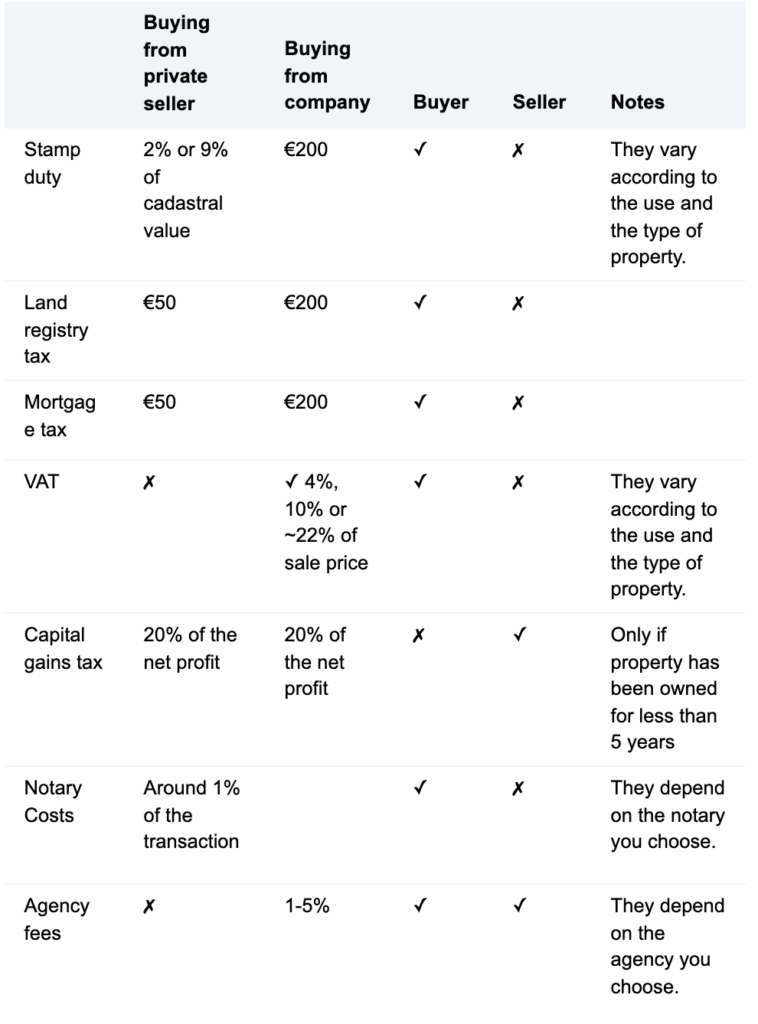

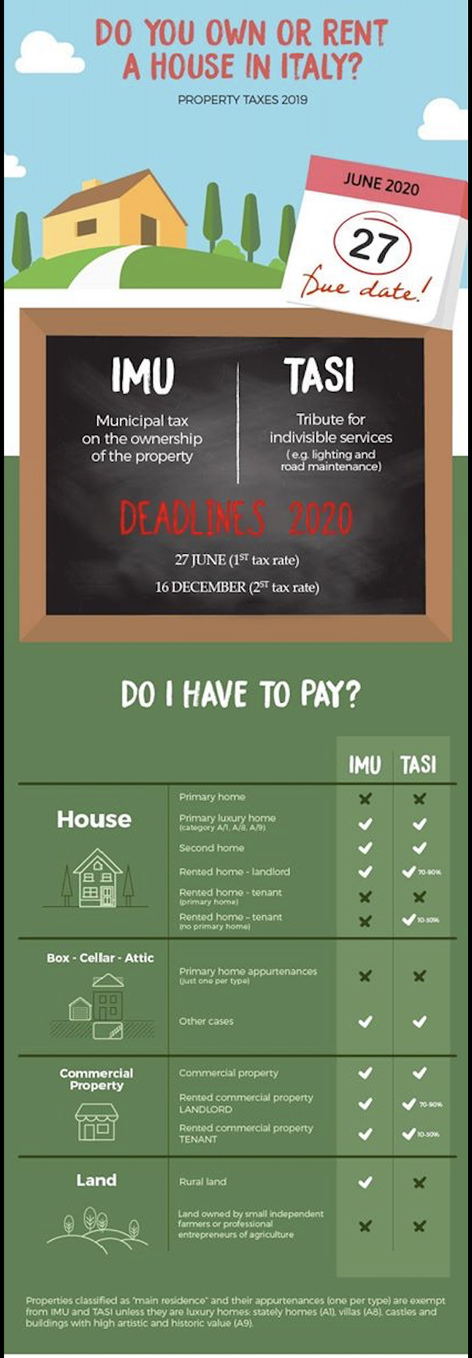

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Taxes In France A Complete Guide For Expats Expatica

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Local Property Taxes In Paris Among The Lowest In The World And Unchanged For The 6th Year Paris Property Group

Property Taxes Could Soar 30 To 50 Business Jhnewsandguide Com

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

Pin By Rijon On Good Inheritance Smoke Bomb Photography Inheritance Tax

Spanish Property Taxes For Non Residents

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla